Freddie mac stock market

When the housing bubble of burst, it caused a mortgage security meltdown. This contributed to a general credit crisiswhich evolved into a worldwide financial crisis. Many critics have held the United States Congress - and its unwillingness to rein in Fannie Mae and Freddie Mac - responsible for the credit crisis.

In this article, we'll examine the extent to which Fannie Mae, Freddie Mac and their allies in Congress contributed to the largest financial and economic crisis since the Great Depression. For background reading, see What Caused The Great Depression? A Brief History of Mortgage Markets For most of the twentieth century, mortgage lending took place mostly at banks, thriftscredit unionsand savings and loans.

The most common type of mortgage was a fixed-rate mortgage and most of the financial institutions originating mortgages held the mortgages that they originated on their books. Starting inwhen Fannie Mae was chartered by the U.

Congress as a government-sponsored enterprise GSEand two years later when Freddie Mac was chartered as the same, things began to change quickly. Fannie Mae was originally created inbut until its privatization in it was a part of the U. Fannie Mae and Freddie Mac created a liquid secondary market for mortgages. This meant that financial institutions no longer had to hold onto the mortgages they originated, but could sell them into the secondary market shortly after origination.

This in turn freed up their funds such that they could then make additional mortgages. To learn more about secondary mortgages, see Behind The Scenes Of Your Mortgage. Fannie Mae and Freddie Mac had a positive influence on the mortgage market by increasing home ownership rates in the United States; however, as history has proved, allowing Fannie Mae and Freddie Mac to function as implied government-backed monopolies had major repercussions that far outweighed the benefits these organizations provided.

The Privileges of GSE Status According to Fannie Mae and Freddie Mac's congressional charterswhich gave them GSE status, they operated with certain ties to the United States federal government and, as of September 6,were placed under the direct supervision of the federal government. For more information on Fannie Mae and Freddie Mac's organization and missions, see Fannie Mae and Freddie Mac, Boom or Boon?

Fannie and Freddie's GSE status created certain perceptions in the marketplace, the first of which was that the federal government would step in and bail these organizations out if either firm ever ran into financial trouble. This was known as an "implicit guarantee". The fact that the market believed in this implicit guarantee allowed Fannie Mae and Freddie Mac to borrow money in the bond market at lower rates yields than other financial institutions.

The yields on Fannie Mae and Freddie Mac's corporate debt, known as agency debtwas historically about 35 basis points. Treasury bondswhile 'AAA-rated' financial firms' debt was historically about 70 basis points. A basis-point difference might not seem like a lot, but on borrowings measured in trillions of dollars, it adds up to huge sums of money. For more on agency debt see, Agency Bonds: Limited Risk And Higher Return.

Private Profits With Public Risk With a funding advantage over their Wall Street rivals, Fannie Mae and Freddie Mac made large profits for more than two decades. Over this time period, there was frequent debate and analysis among financial and housing market professionals, government officials, members of Congress and the executive branch about whether Fannie and Freddie's implied government backing was working mostly to benefit the companies, their management and their investors, or U.

One thing was clear: Fannie Mae and Freddie Mac were given a government-sponsored monopoly on a large part of the U. It is this monopoly, combined with the government's implicit guarantee to keep these firms afloat, that would later contribute to the mortgage market's collapse. For more on the secondary mortgage market, see Behind the Scenes of Your Mortgage.

Fannie and Freddie's Growth Fannie Mae and Freddie Mac grew very large in terms of assets and mortgage-backed securities MBSs issued.

With their funding advantage, they purchased and invested in huge numbers of mortgages and mortgage-backed securities, and they did so with lower capital requirements than other regulated financial institutions and banks.

Figures 1 and 2, below, produced by the companies' former regulator, the Office of Housing Enterprise Oversightshow the incredible amount of debt issued by the companies, their massive credit guarantees, and the huge size of their retained portfolios mortgage investment portfolios.

Treasury debt is used as a benchmark. A Cause for Concern Fannie Mae and Freddie Mac had many critics who tried to raise a red flag of concern about the risks the companies were allowed to take thanks to their implicit government backing. However, despite these early warning cries, Fannie Mae and Freddie Mac found many allies in Congress.

Maintaining Monopolies While Fannie Mae and Freddie Mac's rivals, along with some public authorities, called for tighter regulation of the mortgage giants, the companies hired legions of lobbyists and consultants, made campaign contributions through their own political action committees, and funded nonprofit organizations to influence members of the U. Congress to ensure that they were allowed to continue to grow and take on risk under their congressional charters and implied federal backing.

The GSE's Wall Street Rivals Join the Party It should come as no surprise that Fannie and Freddie's rivals on Wall Street wanted in on the profit bonanza of securitizing and investing in the portion of the mortgage market that the federal government had reserved for Fannie Mae and Freddie Mac.

They found a way to do this through financial innovationwhich was spurred on by historically low short-term interest rates. To learn more, read What is securitization? Starting in aboutWall Street began to make a liquid and expanding market in mortgage products tied to short-term interest rates such one-year CMTMTALIBORCOFICOSI and CODI.

They frequently had "exotic" characteristics such as interest-only or even negative-amortization features. Subprime lending took off. For more insight, see Subprime Lending: Helping Hand Or Underhanded?

Investors such as pension fundsforeign governments, hedge funds and insurance companies readily purchased the sophisticated securities Wall Street created out xkcd stock market engineers all the mortgages it was now purchasing. As Fannie Mae and Freddie Mac saw their market shares drop, they too began purchasing and guaranteeing an increasing number of loans and securities with low credit quality.

The Party Ends When Home Prices Stagnate and Fall It's a simple fact that when home prices are rising, there is less risk nse call option chain mortgage default. The equity in a home is the single biggest risk measure of default.

Homeowners with large amounts freddie mac stock market equity do not walk away from their mortgages, and can usually refinance out part time jobs in bangalore without investment from home based a mortgage with soon-to-be-expected payment increases into another mortgage with low initial payments.

This is the model upon which homeowners, mortgage originatorsWall Street, credit rating agencies and investors built the mortgage bonanza. When the housing bubble burst, so did all of their sophisticated risk models. To learn more, read How Will The Subprime Mess Impact You? InFannie Mae and Freddie Mac began to experience large losses on their retained portfolios, especially on their Alt-A and subprime investments. Inthe sheer size of their retained portfolios and mortgage guarantees led the FHFA to conclude that they would soon be insolvent.

By September 6,adding to win trade forex was clear that the market believed the firms were in financial trouble, and the FHFA put the companies into " conservatorship ". American taxpayers were left on the hook for future losses beyond the companies' existing - and shrinking - capital cushions. Congress is Largely freddie mac stock market Blame Members of the U. Congress were strong supporters of Fannie Mae and Freddie Mac.

Despite warnings and red flags raised by some, they continued to allow the companies to increase in size and risk, and encouraged them to purchase an increasing number of lower credit quality loans. While it is probable that Wall Street would have introduced innovative mortgage products even in the absence of Fannie Mae and Freddie Mac, it might be concluded that Wall Street's expansion into "exotic" mortgages took place in part in order to compete and take market share from Fannie Mae and Freddie Mac.

In other words, Wall Street was looking for a way to compete with the implicit guarantee given to Fannie Mae and Freddie Mac by the U.

Meanwhile, Fannie Mae and Freddie Mac's debt and credit guarantees grew so large that Congress should have recognized the systematic risks to the global financial system these firms posed, and the risks to U.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Fannie Mae, Freddie Mac And The Credit Crisis Of By Barry Nielsen Share.

According to their congressional charters: The president of the United States appoints five of the 18 members of the organizations' boards of directors. Both companies are exempt from state and local taxes.

Both companies are regulated by the Department of Housing and Urban Development HUD and the Federal Housing Finance Agency FHFA.

Federal takeover of Fannie Mae and Freddie Mac - Wikipedia

The FHFA regulates the financial safety and soundness of Fannie Mae and Freddie Mac, including implementing, enforcing and monitoring their capital standards, and limiting the size of their mortgage investment portfolios; HUD is responsible for Fannie and Freddie's general housing missions. Office of Federal Housing Enterprise Oversight Figure 2 Source: Office of Federal Housing Enterprise Oversight A Cause for Concern Fannie Mae and Freddie Mac had many critics who tried to raise a red flag of concern about the risks the companies were allowed to take thanks to their implicit government backing.

These two companies are crucial to the mortgage market, but are they ticking timebombs? If you're risk-adverse, you might want to avoid investing in Fannie Mae. But if you're up for it, high risk could translate to high reward.

Is Freddie Mac an Incredible Value Stock? 3 Reasons Why FMCC Will Be Tough to Beat - Tale of the Tape - oxicivaru.web.fc2.com

Fannie Mae and Freddie Mac are under increased scrutiny as debates continue about conservatorship, share price, and profit allocations. Chances are that you've heard of Fannie Mae. But do you know what it does and how it operates? Fannie Mae officially the Federal National Mortgage Association, or FNMA is a government-sponsored enterprise GSE — that is, a publicly traded company which operates under Congressional charter Fannie Mae and Freddie Mac have come to terms with lenders on how to solve mortgage disputes.

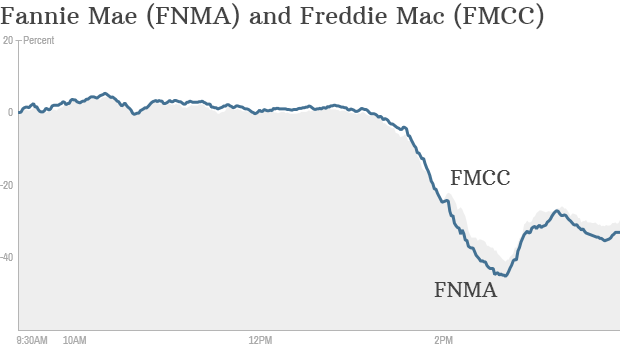

This could be good news for people with lower credit ratings. Freddie Mac may follow Fannie Mae's example and guarantee financing in the single-family rental market. Appeals court ruling against hedge funds sees shares of Freddie and Fannie tumble.

Find about the individuals, funds and companies that are top shareholders of Fannie Mae stock. Learn about their profiles and their relationships with Fannie Mae.

Fannie Mae is a government-sponsored enterprise GSE established in to expand the flow of mortgage money by creating Learn about Fannie Mae Selling Guide and find out details about how its parts provide support to the business relationship Fannie Mae the Federal National Mortgage Association, or FNMA is a government-sponsored enterprise established to expand Learn about the mortgage application form, what information it requires and why this form is the industry standard for An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable.

Huge Value In Fannie Mae's And Freddie Mac's Common Stock - Fannie Mae (OTCMKTS:FNMA) | Seeking Alpha

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.