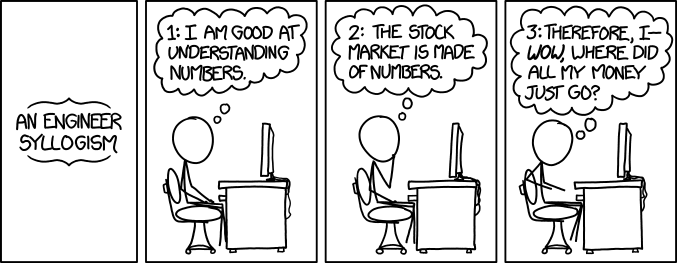

Xkcd stock market engineers

Moderators General , Prelates , Magistrates. Users browsing this forum: All the money went to his company. Unstoppable force of nature. Has committed an act of treason. I am good at poking people in the face 2: The world is full of faces 3: Therefore I - Ow!

Why'd you poke me in the face? I managed to double my money on MTGox before it exploded I'm almost certain I've seen something very much like it somewhere before. But then, it's not impossible for two people to come up with the same idea independently. Forster Barry Schwartz TED Talk: I see this as a PSA refresher for all "numbers" people who may be susceptible to this. I'm getting a real sense of deja vu from this comic. The idea that someone who thinks they are good with numbers or math who then attempts to game the stock market and fails is not a new idea.

Talk Engineer Syllogism - explain xkcd

But if you're willing to play the long game, you can do very well. I invested a few hundred dollars in Apple stock back in the mids. It's now enough to put one of my kids through college. But most of my money is in low-overhead funds. Maybe beret guy started with a similar, less unambitious syllogism: It has more the smell of a scam than a puzzle. This is a world full of irrational, unpredictable humans with biases and systemic advantages looking to fuck you over as unfairly as they possibly can; why would anyone think they could figure out its rules and expect to be able to push buttons and get predictable responses?

You can't "game" a human being, at least not one with two braincells to rub together; that game is sapient and if it sees you trying to play by rules you have inferred from its behavior, it will change the rules because it is actively trying to prevent you from winning at any cost. Forrest Cameranesi, Geek of All Trades "I am Sam. I do not like trolls, flames, or spam. A Webcomic Of Intelligent Weirdness.

Personally, as someone prone to seeing certain complex systems as puzzles in need of solving, the stock market never looked to me that way. Pretty early on in an engineer's education you learn that you generally don't get something for nothing, that there are all these conservation laws; if something looks too good to be true, it probably is.

A way of making a killing on the financial markets rings the "perpetual motion machine" alarm. Well, a bad one, maybe. The sort of egotistical "I understand everything" sort that winds up in engineering management via the Peter Principle, after overlooking too many design-breaking issues. Engineers aren't particularly good with numbers.

Engineer Syllogism - explain xkcd

We have brains that see patterns, understand systems, and solve problems. Which is why the only stocks I've owned outright have been in the companies I've worked for, via stock options or a stock purchase program. And then getting crushed by all the high-frequency robot trading programs that are already doing this, while having their data-centers located as physically close to the stock exchange as possible to minimize latency.

I am Lord Titanius Englesmith, Fancyman of Cornwood. See 1 Kings 7: If you put a prune in a juicer, what would you get? Also, bomb president CIA al qaeda JFK twin towers jupiter moon martians [s]emtex. But a stock market isn't subject to conservation laws like energy is. The stock market goes up over time because more copper, and zinc, and coal, and lithium is pulled out of the ground this year than it was last year, because more of it is turned into cars and airplanes and brass doorknobs and batteries, because more of the sun's energy is captured and monetized, because more t-shirts are made and more coca-cola is bottled.

You don't get something for nothing, that is true, but you do get a real return by doing nothing more than investing money and waiting.

XKCD relevant to current news about the stock market. : financialindependence

In the short term, the stock market can be irrational, but int he long run, the stock market represents the real production of real companies, and it is a positive-sum game.

Just by playing, even if you do it sub-optimally, you're likely to come out ahead. Yes, the pie is continually growing bigger as the aggregate collection of traded companies prosper, but if you want to "rise faster than the tide", then you have to be able to second-guess the other investors, since the best time to sell is RIGHT BEFORE everybody else sells.

It's easy enough to handle your investments such that on average they keep pace with the overall growth of the stock market, but anything that grows faster than the overall market is doing so at the expense of somebody else. Last edited by zanglebert on Sun Aug 30, 5: I read this comic and out loud at work, in a relatively quiet room of 23 other employees, I abrupted "I know right?! That's the official end of my post, you can stop reading if you like.

Considering how the comic is relevant to the topic of investing in the market, what follows is me personally persuading readers who haven't yet to start learning about market investing, then followed by some MINOR investing advice my gf's father gave us that I agree with. But when you actually look into the topic and do a little bit of homework, you find out that the BUY! The core of market investing is putting your money in companies that show potential in succeeding in exchange for letting their profit benefit you over a period of time; the idea wasn't initially based on the attempt of getting wealthy in a month.

There are investing options that are at high risk with the promise of high return, but these aren't options that you have to participate in.

Market investing isn't gambling in the strict definition of the word; the word "gambling," at least here in the United States, implies that the risk of losing your investment is very high. That losing your money is not a surprising outcome at all, but the probability of profit is juuuuust appealing enough to deal with the risk.

Can you lose money in the market even if you play it safe? But in comparison you can also get sick even though you do everything in your power to play it safe and stay well, yet leaving your house every day isn't generally considered gambling with your health.

Like I said before, my gf's father, aware we were studying and researching the topic and looking into investing options, gave us a piece of advice that makes a lot of sense to us and that we intend to follow. If as an investor yourself the following advice doesn't sound good to you or you have a criticism about it, that's fine, I am always open to consider other opinions, but try to remain respectful please. There's no real point in degrading anyone for giving an opinion you don't agree with.

Disagree openly to help inform the good public, sure, but being disrespectful is unnecessary and inappropriate. The biggest mistake anyone can make is withdrawing their long term stakes in fear that the market will never return to stability and that their investment will never return to profit.

The market will always come back up and your investment will be fine. He's obviously just reflecting on his experiences and his own research into the long term results of severe market declines.

His investments lost so much value during the crisis, but, presently, even after the recent decline over China's market worries, his investments are in the green. While many of his friends and family members panicked and sold, cutting their losses because they expected things to get worse, he didn't and is better off for it. In his own personal research, the market has always recovered. Being good with numbers can be beneficial in financial situations; for example when taking a mortgage in the uk, you're often presented with two options: In this case there often really is a right and wrong answer: There's a middle ground where the fee is lower but not by enough to make up for the interest you could earn on the fee in the meantime.

Possibly mathematically challenged people get no-brainers like this wrong all the time, but you wouldn't expect to benefit on financial markets in the same way, since you're up against other similarly mathematically able people. Short-term investment is instead a matter of predicting the behavior of other investors, which is where the "gambling" analogies come into play.

Whenever a bandwagon effect starts going i. If you just look at the numbers, then the stock market is just as unpredictable. So many have lost it all thinking they can predict numbers in a game of roulette.

Right, but I think the contention is that the benefits of strategy plateau at a certain level of skill, but chance still plays a huge role, so people who perform unusually well are statistical oddities rather than uniquely capable people and shouldn't have any better odds of performing unusually well tomorrow than anyone else with a professional level of capability.

Wee Red Bird wrote: If you only look at the numbers and trends in the stock market, you will eventually lose. There are factors outside repeating trends that can cause stock to rise announcement of a takeover or drop someone in a sandy country deciding to produce lots of oil. Using numbers alone is unreliable.

They have made millions Thorpe or billions Simons by using their skills in the stock market. Who is online Users browsing this forum: Board index All times are UTC Delete all board cookies The team Contact us.