Stock option theoretical value

An important distinction in the financial markets is between the theoretical value and the market value of a financial instrument. In this article we will explain the difference and then discuss why it matters.

We will also look at the difference uses of both types of value. This is the market value and is simply the price at which the asset is trading. To know the market value of say Apple shares, we just look up the current price.

This is pretty straightforward and generally not controversial; there is just one market value and it is simply the market price.

The theoretical value of an asset is the output of some sort of model. This could be a sophisticated mathematical model that takes a number of inputs to produce a single theoretical value.

Notice that there can be an unlimited number of theoretical values. Different models and different people can each have their own idea of the theoretical value of an asset. So why does this distinction matter to investors or traders? Another way to understand this is to say that the buyer thinks the market value is too low compared to his theoretical value. He expects that the market value will rise to reflect the under-valuation.

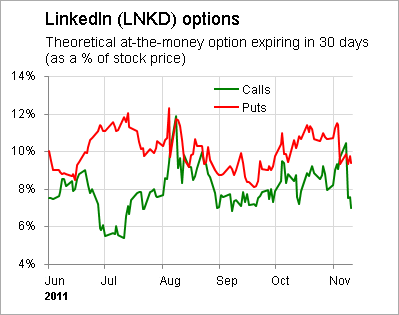

Consider professional option traders. They will typically have theoretical values for all the option contracts they are trading. These will be the output of a mathematical model which takes into account various factors such as the spot price, time to expiry, implied volatility etc. It is not possible for one asset to have two values at the same time!

For risk management, the theoretical vs market distinction is important. For example, when measuring the profit and loss of a portfolio, should the risk manager use the current market value of the assets or some sort of theoretical value? It is not just the value of an asset that can be actual or theoretical Many different parameters which feed into the risk numbers could be theoretical or market-based.

The outputs from the risk models as opposed to their pricing models will also therefore be dependent on whether market or theoretical values are used.

In short then, it is not just the profit and loss that can have two interpretations market vs theoretical. Risk metrics as well can be fully dependent on whether market or theoretical values of other parameters are used. In Volcube simulations , you typically trade using theoretical option values and the market values are determined by the order flow in the market. Although if you prefer, you can just trade using the market values. Sometimes traders decide to alter their theoretical values, usually because they want to more accurately reflect the market value.

There are several reasons for this; as mentioned above it is not just the profit and loss that is a function of the type of value used, but also the risk metrics which can be affected by the value.

Options Trading Strategy on MACD Divergence - The Options Hunter

So this is one reason to decide to re-align theoretical values. You can practise this as well in Volcube simulations by using the Volcube volatility manager. It is important to understand the difference between the theoretical and market value of any financial asset, particularly when reviewing trading results. You can access Volcube Starter Edition for FREE.

Starter Edition has been designed specifically for individuals who want to learn about options trading from home or at work. If you want to learn about options trading, try Volcube out for free today!

Click here to get start your completely FREE trial. The options market simulator is a fantastic way to learn, simple to use and a lot of fun!

The videos and articles are comprehensive and easy to understand, and the Volcube Team offers you excellent support whenever you need it.

Hughes Optioneering

Products Volcube Starter Edition Volcube Pro Edition Testimonials Store Volcube simulators Ebook store Compare Volcube Resources Options articles Options ebooks Recommended reading Support Volcube Tutorials Options Trading FAQs Options Training About What is Volcube?

News Company Contact us. Navigate Volcube Starter Edition Products Options articles About Support Terms and conditions Site Map Privacy and cookie policy.