Trading uvxy options

Example option expire on Jan for UVXY, you can have ability to change the expiration month.

ProShares Trust Ultra VIX Short Term Futures ETF (UVXY) Option Chain - Stock Puts & Calls - oxicivaru.web.fc2.com

Let me know if anyone wants to work on this as team. I have lots of Idea to share.

I am not a tech person.. Hi Saief, see this https: Saief, I built an options backtester for personal use in R. It's a little more in-depth than just inputting an option expiration date. Need entry parameters like delta, dte, and then signals for exiting too.

Let me know if you want to collaborate. Hey Sorry for delay on replay. I am on vacation and I should be back soon, I am interested to collaborate and create those strategy.

We shall talk soon. Sorry, something went wrong.

Try again or contact us by sending feedback. Point72 is a family office. Point72 does not seek, solicit or accept investors that are not eligible family clients. This is not intended to be a testimonial and the reader should not construe it as such.

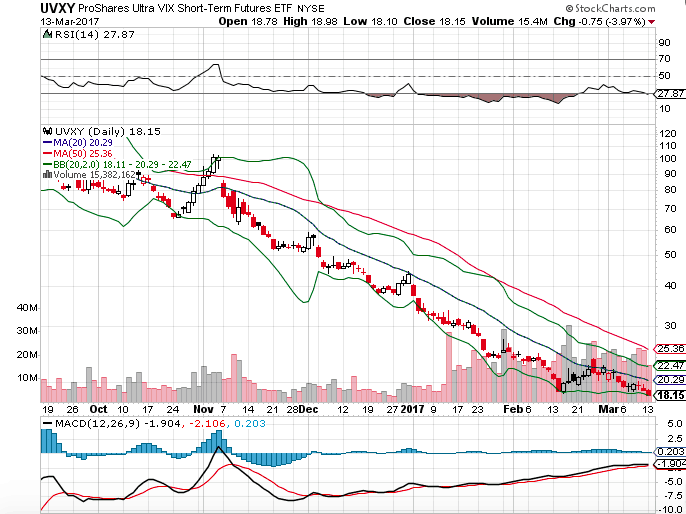

ProShares ETFs: Ultra VIX Short-Term Futures ETF - Overview

The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by Quantopian. In addition, the material offers no opinion with respect to the suitability of any security or specific investment.

No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action as none of Quantopian nor any of its affiliates is undertaking to provide investment advice, act as an adviser to any plan or entity subject to the Employee Retirement Income Security Act of , as amended, individual retirement account or individual retirement annuity, or give advice in a fiduciary capacity with respect to the materials presented herein.

If you are an individual retirement or other investor, contact your financial advisor or other fiduciary unrelated to Quantopian about whether any given investment idea, strategy, product or service described herein may be appropriate for your circumstances. All investments involve risk, including loss of principal. Quantopian makes no guarantees as to the accuracy or completeness of the views expressed in the website.

The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances. Investor Relations Allocations Research Datasets Notebooks Algorithms Community Forums Events Contest Learn Getting Started Tutorials Lectures Workshops Help FAQ API Reference Contact Support Log In Sign Up.

I have more to share on how it will work. Hi Michael How are you?.. I trade options on UVXY, the spreads are wide and it's hard to get filled. Please sign in or join Quantopian to post a reply. Once you join, you can: Run full backtests, with detailed risk metrics and full transaction reports. Algorithm Backtest Live Algorithm Notebook. Sorry, research is currently undergoing maintenance.

Trade Idea of the Week UVXYPlease check back shortly. If the maintenance period lasts longer than expected, you can find updates on status.

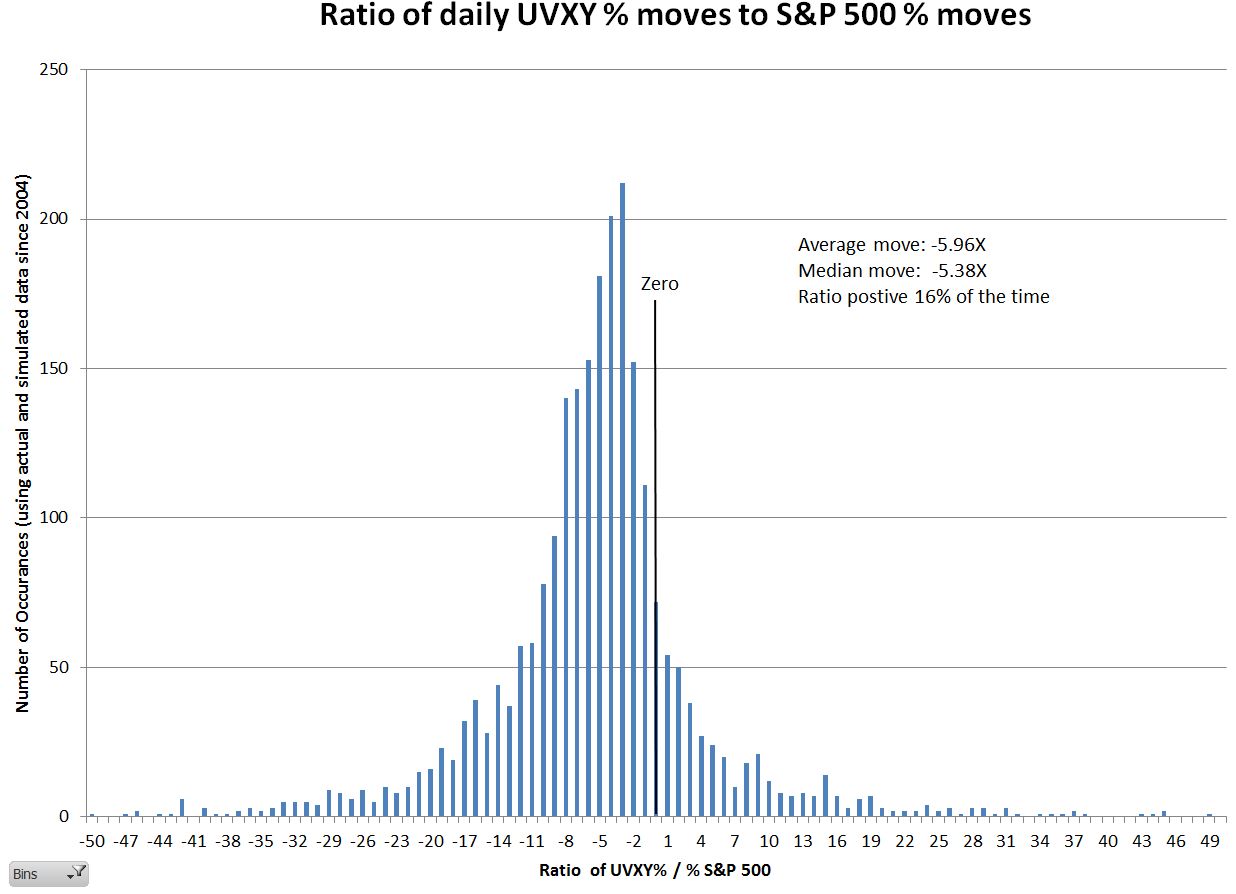

Unless You Want to Lose Money, This is the Only Way to Trade the VIX | ProfitableTrading

Sorry, something went wrong on our end. Please try again or contact Quantopian support.

You've successfully submitted a support ticket. Our support team will be in touch soon. Send Error submitting support request.