Trading intraday breakout patterns

My Favourite Intraday Trading Patterns • JB Marwood

Today I want to discuss a few different chart patterns that beginners should focus on when they first start out day trading. Many traders start out with what I call indicator fascination and delve into advanced analysis methods that can confuse them and often times discourage them from continuing trading.

When I started out trading I was under the impression that the more difficult trading methods would produce bigger winners or higher probability of winning trades. I purchased several books and magazines that discussed Gann Lines, Geometric calculations and Elliot Wave Principles that required a PhD in physics to understand correctly. It goes without saying but I can promise you that the only thing I learned after following these methods was to stay away from them as far as possible.

Fortunately, I met a few professional traders who mentored me and showed me some simple strategies that got me on the right track and more importantly made me understand that profitable trading is not about complex and confusing trading patterns or strategies but about finding simple methods that matched my emotional make up and my risk tolerance.

The most fundamental mistake beginners make is beginning their search for chart patterns using intraday time frame. I always encourage traders to begin their analysis with daily time frame and then move on to intraday time frame when they are actually getting ready to enter the trade.

While there are some markets such as E-mini SP futures and Forex markets that you can begin analyzing using hourly or shorter time frame bars. However, for the most part most financial instruments respond best to daily chart analysis to begin with. I want to wait for the initial breakout to occur so that I can day trade if the stock continues momentum after the breakout.

Usually after a tight symmetrical triangle, the stock is very wound up and is ready for strong momentum that should last 2 to 5 days.

You can see the actual entry in this example. Notice I completely relied on the daily chart how does binary options work 360 review my analysis, entry and exit. In this case the triangle breakout continued upwards e mini s p 500 futures trading hours and closed near the high of the day.

I would use a simple MOC market on close order to liquidate the position at the end 60 second traderush binary options broker uk the day. What I like about triangles is the inherently limited risk due to lack of volatility while the pattern is setting up.

This is one of the reasons why triangles are good low risk high reward patterns for beginners. Make Sure The Market You Choose Demonstrates High Volatility Before Entering The Triangle Pattern. The next low risk day trading chart pattern I want to show you is the bullish flag pattern. Notice the risk level is equal to the size of the bars that make up the flag.

I would look for a strong breakout day outside of the flag for an upside entry. Flags are congestion patterns that tend to explode with good momentum once the congestion phase comes to an end. Breakouts From Bullish Flag Patterns Typically Begin With Strong Momentum.

You can see the entire sequence in this example. Notice how low the risk level can be when the bars before the breakout are consolidating and have a tight trading range; these are the type of patterns you want to isolate for day trading. The risk is very trading intraday breakout patterns compared to the profit potential and because your entering right after the consolidation stage the market is primed for volatility.

The profit on this trade was close to three dollars and the risk level was close to one dollar. Unfortunately, day trading does not provide opportunity for huge profits because you are limited to how much time your position has to develop. You should look for set ups that provide you with a two to one risk opportunity at a minimum. Start Day Trading with simple patterns that make sense. Avoid difficult mathematical formulas or calculations that involve geometry or statistics. Look for opportunities that provide high potential reward and low risk so that the size of the winners is at least twice the size of your losers.

In day trading the profit potential is limited because the market is only open for a limited amount of time. You need to maximize your profit potential by picking simple trading patterns that make sense to you.

For more on this topic please go to: Member Login Technical Support. Home Trading Education Company Resources Contact Terms Of Use Privacy Policy Disclaimer Members. Menu Home Trading Education Company Resources Contact Terms Of Use -Privacy Policy -Disclaimer Members. Don't Miss Swing Trading Stocks Strategies Swing Trading Stock Ideas — Screening Stocks Retracement Entry Methods Anyone Can Learn Swing Trading Tips For Beginners Swing Trading Methods — Descending Triangle Analysis Short Swing Trading — Selling Short Has Advantages Swing Trading Guru.

Symmetrical Triangles Offer Very Low Risk And High Profit Opportunity.

Home | Intraday Money - Earn Intra Day Profit Without Head Ache of Loss!

The Stock Broke Out Strongly After Two Weeks Of Range Bound Trading. Related Posts How To Pick Winning Stocks. How To Pick Winning Stocks. Cup And Handle Pattern Recognition And Chart Analysis. Financial Outlook Week Ahead. Inside Day Short Term Trading Tactics. Latest News How To Pick Winning Stocks Pick Winning Stocks With Simple Stock Market Analysis Tools Stock Posted June 21, 0.

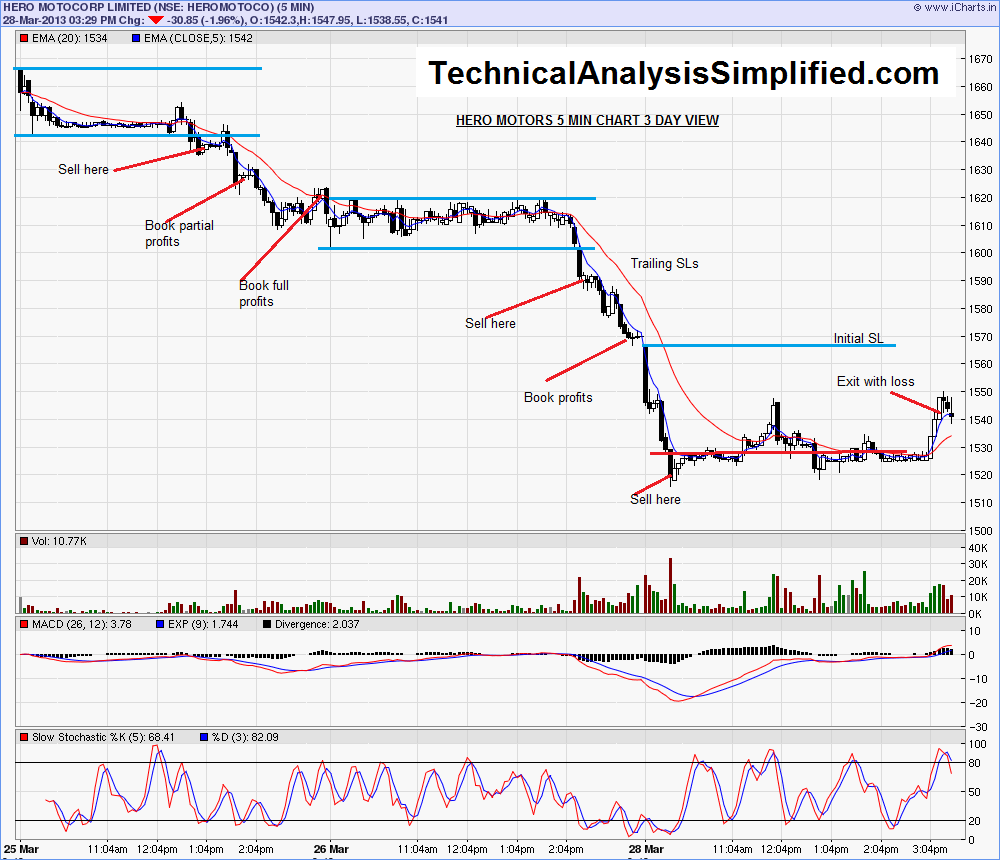

Breakout Trading Strategies For Intraday Trading

Posted June 19, 0. Posted June 18, 0. Posted June 17, 0.

Posted June 16, 0. Posted June 15, 0. Posted June 14, 0. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THE FUTURES AND FOREX MARKETS. DON'T TRADE WITH MONEY YOU CAN'T AFFORD TO LOSE. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. Please enter your e-mail address.

You will receive a new password via e-mail.