Market value preferred stock formula

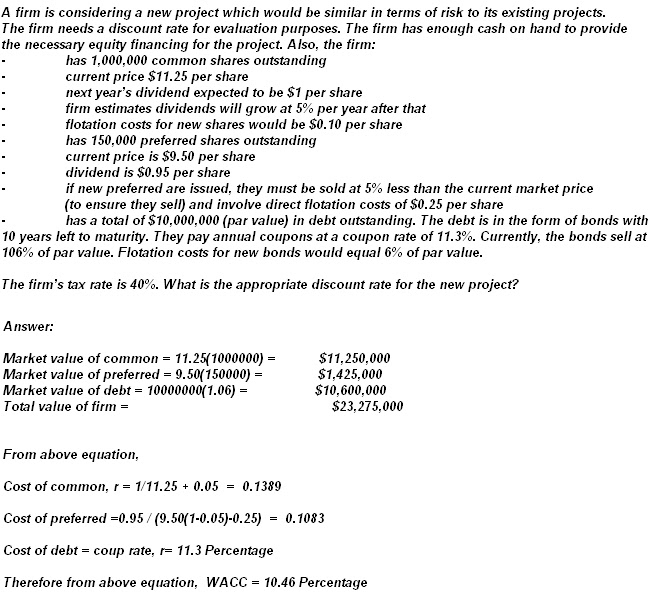

Preferred stock is a type of equity that business firms can use to finance their operations. If a firm uses preferred stock, then its cost must be included in the company's weighted average cost of capital calculation.

Like common stock , preferred stock dividends are not tax-deductible. The only component in the cost of capital calculation that pays tax-deductible income is debt. Preferred stockholders do not have to be paid dividends, but the firm usually pays them. If they don't, they can't pay dividends to their common shareholders and it is a bad financial signal for the firm to send out.

How to Calculate Dividends on Preferred Stock | oxicivaru.web.fc2.com

If preferred stock has no stated maturity date, here is the formula for calculating the component cost of preferred stock:. Usually, the cost of preferred stock will be higher than the cost of debt as debt is seen as the least risky component cost of capital.

If a firm uses preferred stock as a source of financing, then it should include the cost of the preferred stock in the weighted average cost of capital formula.

Most preferred stock is held by other companies instead of individuals. The weighted average cost of capital is the average interest rate a company must pay to finance its assets.

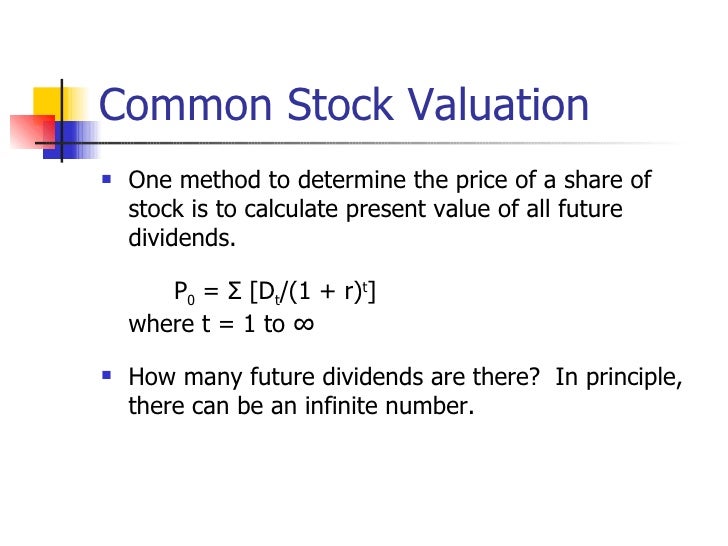

As such, it is also the minimum average rate of return it must earn on its current assets to satisfy its shareholders or owners, its investors, and its creditors. Weighted average cost of capital is based on the business firm's capital structure and is composed of more than one source of financing for the business firm ; for example, a firm may use both debt financing and equity financing.

Cost of capital is a more general concept and is simply what the firm pays to finance its operations without being specific about the composition of the capital structure debt and equity. Some small business firms only use debt financing for their operations.

Other small startups only use equity financing , particularly if they are funded by equity investors such as venture capitalists. As these small firms grow, it is likely that they will use a combination of debt and equity financing. Debt and equity make up the capital structure of the firm, along with other accounts on the right-hand side of the firm's balance sheet such as preferred stock.

As business firms grow, they may get financing from debt sources, common equity retained earnings or new common stock sources, and even preferred stock sources. Search the site GO.

Business Finance Financial Management Starting a Business Obtaining Financing Budgeting Accounting Basics Small Business Crowdfunding Basics Crowdfunding Platforms Crowdfunding News Business Math.

How to Calculate the Book Value of a Preferred Stock - Budgeting Money

Updated February 03, Characteristics of Preferred Stock Like common stock , preferred stock dividends are not tax-deductible. What is Calculation of the Cost of Retained Earnings? Cost of Capital for a Business How to Calculate the Cost of Debt Capital for Your Business Capital Structure - Definition.

How to Use “Magic Formula Investing” to Beat The Market

Get Daily Money Tips to Your Inbox Email Address Sign Up. There was an error. Please enter a valid email address. Personal Finance Money Hacks Your Career Small Business Investing About Us Advertise Terms of Use Privacy Policy Careers Contact.