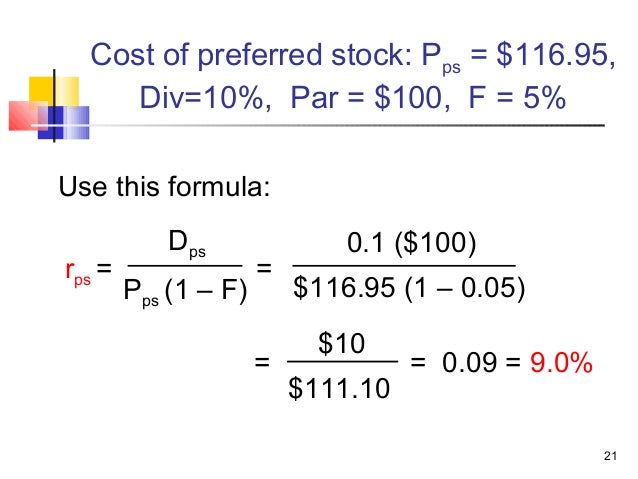

Marginal cost of preferred stock formula

Please note that Macabacus no longer supports Internet Explorer versions 7 and 8. The rate used to discount future unlevered free cash flows UFCFs and the terminal value TV to their present values should reflect the blended after-tax returns expected by the various providers of capital.

The discount rate is a weighted-average of the returns expected by the different classes of capital providers holders of different types of equity and debtand must reflect the long-term targeted capital structure as opposed to the current capital structure.

While a separate discount rate can be developed for each projection interval to reflect the changing capital structure, the discount rate is usually assumed to remain constant throughout the projection period. In situations where projections are judged to be aggressive, it may be appropriate to use a higher discount rate than if the projections are deemed to be more reasonable. While choosing the discount rate is a matter of judgment, it is common practice to use the weighted-average cost of capital WACC as a starting point.

The market values marginal cost of preferred stock formula equity, debt, and preferred should reflect the targeted capital structure, which may be different from the current capital structure.

Even though currency converter rand dollar WACC calculation calls for the market value of debt, the book value of debt may be used as a proxy so 5 binary options 300 seconds as the company is not in financial distress, in which case the market and book values of debt could differ substantially.

The cost of equity is usually calculated using the capital asset pricing model CAPMwhich defines the cost of equity as follows:.

ACCA F9 The weighted average cost of capital (WACC)

Beta is a measure of the volatility of a stock's returns relative to the equity returns of the overall market. It is determined by plotting the stock's and market's returns at discrete intervals over a period of time and fitting regressing a line through the resulting data points.

The slope of that line is the levered equity beta. When the slope of the line is 1. When the slope exceeds 1. Equity betas can be obtained from the Barra Book.

How to Calculate the Marginal Cost of Capital | The Finance Base

These betas will be levered and either historical or predicted. The historical beta is based on actual trading data for the period examined often 2 yearswhile the predicted beta statistically adjusts the historical beta to reflect an expectation that an individual company's beta will revert toward the mean over time.

Weighted-Average Cost of Capital (WACC)

For example, if a company's historical beta is less than 1. Similarly, if the historical beta is greater than 1.

It is generally advisable to use predicted beta. Betas of comparable companies are used to estimate r e of private companies, or where the shares of the company being valued do not have a long enough trading history to provide a good estimate of the beta.

HOME ADD-INS TOPICS Deal Mechanics Sale Processes Purchase and Sale Agreements Private vs. Intrinsic Value FIN Unearned Compensation FIN Weighted-Average Cost of Capital WACC.

Unlevered Free Cash Flow Terminal Value.

Discounted Cash Flow DCF Overview Unlevered Free Cash Flow Terminal Value Enterprise and Equity Values. Connect Facebook Twitter Feedback About Privacy Policy Legal Notices Pronounce.

Build models 5x faster with Macabacus for Excel.