Darvas trading system

Sift through any collection of stock charts and some immediately stand out as clear and obvious trading opportunities.

oxicivaru.web.fc2.com - Trend Trading

We show how this visual test is applied in the second section, HEY GOOD LOOKING. This is not a complicated task and perhaps this is why so many new investors ignore it. Their preference seems to lie with what can only be described as ugly charts when prices fall dramatically from the top left of the chart to the bottom right.

These are investment bargains and they come with an invitation to financial disaster. We discuss ways to avoid these attempts to separate you from your investment capital. The third section, BETTER TREND LINES introduces a different approach to the application and use of trend lines. These are probability tools directly related to the management of the trade.

Many traders use trend lines to define price action, often with a sneaking suspicion that they might be able to predict the future. This section considers these classic applications and then moves beyond them to examine the relationship between the trend line and better trade management.

This turns the trend line into a powerful management tool.

Not all trends are created equal and section four, TESTING CHARACTERincludes an updated and complete discussion of the way the Guppy Multiple Moving Average GMMA indicator is used to assess a trend. The GMMA was introduced in TRADING TACTICS in Since then the indicator has evolved into more advanced and sophisticated applications. For many traders it has become the core way of understanding trend behaviour and indicating the type of trading opportunity.

This section is a detailed discussion of the trading and investment applications of the GMMA. Before a stock is added to our portfolio we need a PRICE CHECK to more precisely define the trend, our entry point, and to commence the calculations necessary to manage risk.

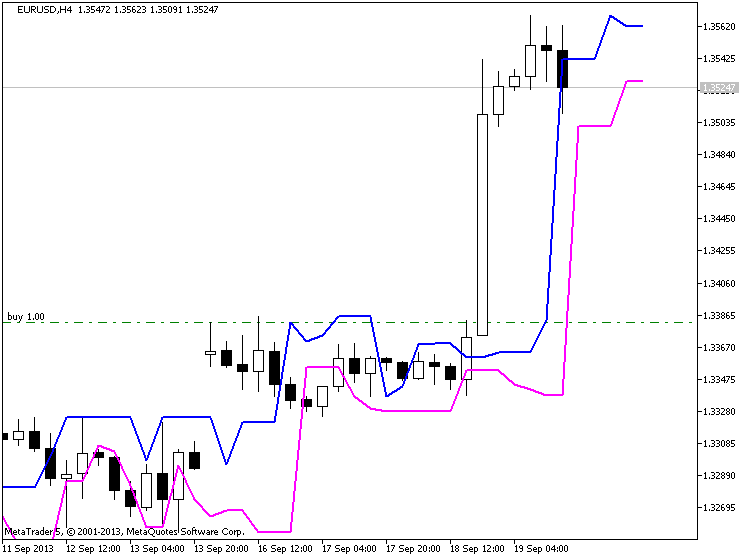

Bulkowski's Darvas Box

Our preferred tool is the count back line. This was introduced in SHARE TRADING in and this technique has also evolved with more sophisticated applications.

We show how this is applied to mid-trend entries.

We also show how the count back line is combined with forex traders in nigeria GMMA as a protect profit tool as the trend develops. This is a powerful trend trading combination. They believe they are powerless when confronted with the force of the market. This is simply not true and we examine some of the methods designed to effectively manage risk while leaving reward uncapped.

The necessary figures are easy to produce, but implementing an effective stop loss or protect profit strategy is much more difficult. Our reaction to risk changes with experience, and unless we recognise these changes we may stumble on the path to success. MODERN DARVAS in section seven is an important detour.

The approach developed by Nicholas Darvas represents an entirely different way of understanding trend behaviour. We examine the classic Darvas application. We retain the logic of his understanding of trend darvas trading system and update the technique for application in modern, volatile markets. We use six tests to select the best trend trading candidate, and no test is complete without a test poker wsop moneymaker ivey. We start a trade with the best of intentions, and then turn it into a trading wreck.

This is Jekyll and Hyde trading where our darvas trading system laid plans and intentions are thrown overboard when it comes time to act. There are no easy solutions to resolve this behaviour, but our discussion is designed to help you recognise the problem. We also examine a technique to separate luck form skill when assessing your trading results.

This section also concludes the NO SECRETS trading tests. Readers who resisted the temptation to flip forward to find the test answers can enjoy the opportunity to measure their performance and reactions against those who took the original test in real time.

Success may appear difficult or impossible when everybody knows exactly the same information, but this is just a mirage. Profits come from the way we use information and we can all be successful. This is the true secret of performance plus in trend trading. Read a sample chapter for TREND TRADING - A SEVEN STEP APPROACH FOR SUCCESS.

Darvas Trader — Nicolas Darvas Stock Trading

SUMMARY Where do we start and what do we need? Common solutions rarely lead to uncommon profits so we spend a little bit of time examining some common ideas to see if they are really useful.

This includes several simple methods of finding suitable trading opportunities. The market is complex, but solutions for breaking into it need not be.

Simple tools give us access to good profits in the market.

The final chapter in the first section introduces the first of eight on-going tests for readers. One of the most pernicious and incorrect of common misconceptions about market success suggests we need exclusive information, or systemor technique for success. The tests are based on similar work we did with newsletter readers so you can compare your results and reactions with theirs.